The reality is that if you are really good at it, you wouldn’t be farming, you would be on your yacht in the Caribbean and not trying to get a tractor to start when it’s 6 degrees out. Do not take anything I say as advice, as you could lose all your money and you will be forced to sell feet pictures on the internet to strangers, and trust me that will be a tough way to make a living for a gnarled old farmer. I don’t have all the answers, and in fact I have lost money on every dairy hedging program out there, and probably financed a few parties in Chicago with margin calls. Do not make any marketing decisions based on anything I say, and consult with a certified professional before trading futures and options.

I started my introduction to futures and options the easy way, jumping in with both feet and just doing it, which turned out to actually be the hard way. A spry young 25 year old me put $7,000 in a futures account with a clearing house called MF Global. Hold onto your hats kids. I started using it to hedge my product appropriately, buying my inputs of corn, soybeans, and oil. Selling calls and buying puts to establish a floor. Selling two calls to buy a higher put. Then rather than buying more cows, I bought the milk futures, then bought cattle futures. I was a paper cowboy without the need to brand cattle and castrate. Why stop there? I started buying short dated call options in silver and gold, close to expiration. In six months I had turned $7,000 into $50,000 and was ready to write a book and buy the yacht. Then everything flipped. I couldn’t make money on a single trade, and in 1 month I had lost the $50,000. Ironically my collapse culminated with another collapse in that of MF Global. MF Global had taken on bad government bonds in European countries that were off of their balance sheet and it triggered margin calls that could only be covered by stealing customer funds. End of story for MF Global and an incredibly expensive introduction for me on the do’s and don’ts of futures and options.

Managing risk is an integral part of agriculture. There are crop risks, input risks and revenue risks. There have never been more tools available than there are today for farmers to hedge and navigate those risks. Here are a few of the options available for dairy farmers today, and some of the tools that I use.

DMC:

The Dairy Margin Coverage program is a no brainer for every dairy farm. It is an insurance program that guarantees a specific margin between the cost of feed and the milk price. While it is not a perfect hedge as feed costs and milk revenue can vary wildly, it is a great proxy that pays well when margins have collapsed. The downfall of the program is that it is limited to 5 million pounds of milk per year, however it can cover 100% of milk produced for herds around 250 cows, and has historically paid out dramatically more money than the insurance premiums.

DRP:

The Dairy Revenue Protection program in my mind is a great program to layer on top of DMC for those who have production which exceeds the 5 million pounds a year. DRP is essentially a put option or a floor on your Class III or Class IV milk production. This price is subsidized by the USDA and insured by private crop insurance agents. DRP establishes a floor and leaves the upside open. There is an added benefit in that payment for the policies is required after the quarter has expired, which for a true hedger should allow a producer to have the cash on hand to pay the premium. A downside has been the increased cost of the program as insurers have lost money on these programs, the cost to insure has gone from .40 per cwt up to $1 or more.

Futures and Options:

Selling the futures, is locking in the part of your milk check that is made up of the Class III or Class IV portion of your milk check. A futures contract is an agreement on the price of a commodity for a specified month. Simplistically, if I want to guarantee that I get $20 on the Class III or cheese portion of my milk check in March of 2023 and I agree to sell the contract. Domino’s Pizza is scared that they may not be able to sell a $8 cheese pizza to frat boys digging for change in their couch so they buy the contract. If the month of expiration sees the price go to $18 Domino’s makes up the difference. If the price goes to $23, I make up the difference. Rather than selling the futures contract, I could buy $20 Put Option or floor on that milk. A $20 put at a cost of $1, allows me the right to sell at $20 or $19 after my premium cost. In order to help finance the expensive premium, I may go and sell a $22 Call Option which gives the owner of the option the right to buy milk at $22. My sale of a $22 call option gives me $1 with which I can buy the $20 put option. What does this give me? A floor of $20 and a ceiling of $22, and hopefully I’ve locked in a profit. I’m hungry for cheese pizza.

Zisk:

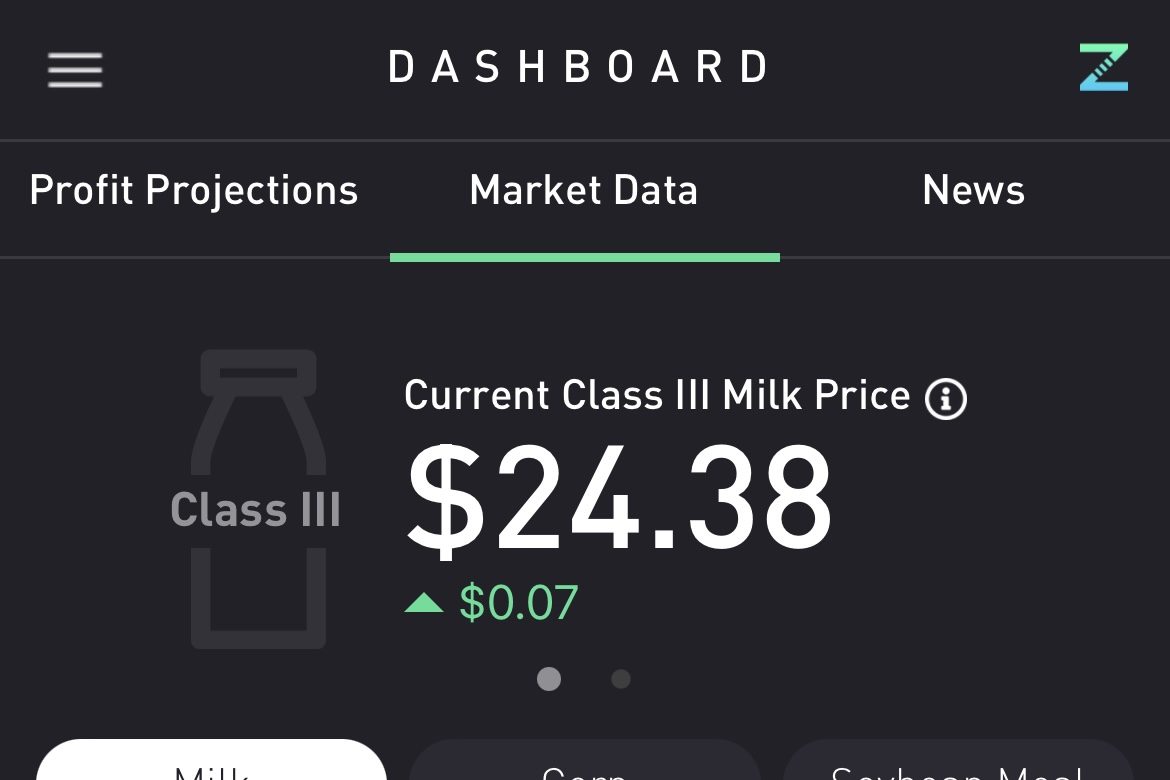

One of the tools that I also use is the Zisk app. Zisk allows producers to get updated Milk, Corn and Soybean Meal prices. This data can also be put in a 12 month projection of profitability. Zisk is the Polish word for profit, and it’s an app that allows a farmer to project their profit using real time data from the CME. Users input their herd size, daily milk production, bonus per cwt, and the composition of Class III and IV in their pay price. Zisk then takes this data to extrapolate what your monthly milk revenue and feed input costs are going to be. Zisk also allows you to input your futures contracts on Milk, Corn and Soybean Meal to help paint a picture of where you are at. It is free to use, and can help to paint a picture of what the next 12 months look like. I have also set up alerts into the app so when Milk, Corn or Soybean Meal hit price targets that my broker and I have designated, it will send me an email and push notification on my phone. Managing both the revenue and expense side of a dairy operation is one of the most important jobs on the farm, and being able to see the margin we are forecasted to operate with is incredibly valuable.

One of the tools that I also use is the Zisk app. Zisk allows producers to get updated Milk, Corn and Soybean Meal prices. This data can also be put in a 12 month projection of profitability. Zisk is the Polish word for profit, and it’s an app that allows a farmer to project their profit using real time data from the CME. Users input their herd size, daily milk production, bonus per cwt, and the composition of Class III and IV in their pay price. Zisk then takes this data to extrapolate what your monthly milk revenue and feed input costs are going to be. Zisk also allows you to input your futures contracts on Milk, Corn and Soybean Meal to help paint a picture of where you are at. It is free to use, and can help to paint a picture of what the next 12 months look like. I have also set up alerts into the app so when Milk, Corn or Soybean Meal hit price targets that my broker and I have designated, it will send me an email and push notification on my phone. Managing both the revenue and expense side of a dairy operation is one of the most important jobs on the farm, and being able to see the margin we are forecasted to operate with is incredibly valuable.

Several years ago our co-op was invited to Starbucks headquarters to meet with some of their management team and listen to their risk management team. I was sitting next to the person who managed their team and asked her how often their team made money managing risk for coffee, milk, and cocoa. Her response was, “rarely ever.” She then made the comment that was not the goal of managing risk. The goal was to consistently make money for shareholders every single quarter. As we grow into larger and larger dairies, we too need to make money every single quarter. This allows us to have cash when the industry is struggling and there are opportunities for expansion. This allows us to create a narrative that we are bankable and wanted by lending institutions. Finally, this gives us peace of mind and reduces stress knowing that we have the cash inflows to pay all our expenses.

One of the other misnomers is that we don’t have to market our milk as dairy farmers, we just make the milk and get a check in 30 days. When we don’t forward contract our milk, we simply accept the price of milk at the time of expiration of the milk contract. There are roughly 240 days for you to make a decision on when to sell the milk you are going to sell a year from now. You could do nothing and accept the price on the final day, or you could look for an opportunity to sell it earlier. Go out and manage that risk.

Happy Hedging!